Table of Contents:

Welcome to the fascinating world of financial trading, specifically with a focus on RSI Indicator Strategies. Today's article is designed to be an accessible, comprehensive guide on how this vital financial tool can help identify trading opportunities. RSI, or the Relative Strength Index, can indicate overbought and oversold conditions in the marketplace. This guide is not just for seasoned investors but also those new to the world of financial trading, cryptocurrencies, and anyone interested in diversifying their portfolio.

Introduction to RSI Indicator Strategies

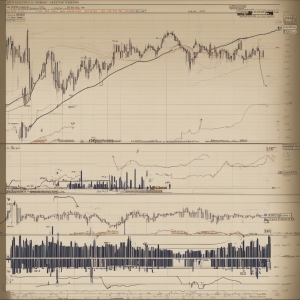

Before diving straight into the specific strategies using the RSI indicator, let’s first understand what RSI is. The Relative Strength Index (RSI) is a momentum indicator, widely used in technical analysis to help traders predict future price trends. Created by J. Welles Wilder Jr, it's a powerful tool that measures the speed and change of price movements.

The RSI is displayed as an oscillator, a line graph that moves between two extremes, generally between 0 and 100. It's primarily used to identify overbought or oversold conditions in a market which are potential signals for market reversals.

But how can you, as an investor, use this tool to create profitable RSI Indicator Strategies? The key is understanding how to read the RSI and interpret its signals within the context of broader market conditions. The following sections will delve deeper into this topic, simplifying the complex and making it easier for newcomers to grasp.

Understanding the Basics of RSI

At its core, the RSI indicator is a tool for spotting potential market reversals. Specifically, traders use the RSI to find overbought and oversold conditions in the marketplace. An overbought condition is signified when the RSI rises above 70. This typically indicates that a particular cryptocurrency or other asset might be getting overvalued and is potentially due for a price correction or downturn.

On the other hand, an oversold condition is signified when the RSI drops below 30. This suggests that the asset may be undervalued, and there could be a chance of a price rebound in the near future.

Both of these scenarios offer potential opportunities for traders. By successfully identifying the overbought and oversold conditions, traders can make educated guesses on when to enter and exit positions, maximizing their potential gains and decreasing their risk of a loss. But remember, while the RSI is a helpful tool, it should be only one component of a comprehensive trading strategy.

Evaluation of RSI Indicator in Identifying Overbought and Oversold Conditions

| Pros | Cons |

|---|---|

| RSI can be a useful tool in determining market trends. | RSI may produce false signals in a highly volatile market. |

| The RSI can help identify overbought and oversold conditions in a market. | RSI alone cannot provide a full market picture, and should be used in conjunction with other indicators. |

| It can assist in timing when to buy or sell. | RSI can remain overbought or oversold for a long duration in trending markets, resulting in misleading signals. |

| RSI is a momentum oscillator, providing insight into the speed and change of price movements. | Relevance of RSI readings may vary across different market conditions and securities. |

The Power of Overbought and Oversold Conditions

So why are overbought and oversold conditions of such great importance for traders using RSI Indicator Strategies? The answer lies in their ability to provide insights about extreme market conditions. When a market is overbought, it means that an asset has been subject to significant buying pressure, potentially pushing its price beyond its true value. The resulting implication is that it could soon experience a price correction as traders sell off the asset to cash in on the inflated price, which is perceived as a possible signal to go short on the market.

Conversely, oversold conditions indicate that an asset has been under heavy selling pressure. This generally results in the asset's price falling below its actual worth. As the market starts to acknowledge this underpriced state, buying pressure can increase as investors aim to take advantage of the lower prices. Therefore, an oversold condition is perceived as a probable signal to go long on the market.

These extremes in buying and selling pressures represented by the overbought and oversold concepts are the core tenets of the RSI Indicator Strategies. They highlight potential points of market inflection where a reversal could occur, offering prime opportunities for maximizing trade profits.

Practical Implementation of RSI Indicator Strategies

So we've learned about the RSI Indicator and the key concepts of overbought and oversold conditions. Now, let's move onto practical implementation, exploring ways of constructing effective RSI Indicator Strategies.

First, an investor should look at the RSI in the context of market conditions. A rising market trend might push the RSI into overbought territory, but remember that overbought does not necessarily mean a reversal is imminent. Strong upward trends can stay overbought for extended periods. Therefore, timing an exit purely based on RSI being overbought may cause an investor to miss out on potential gains.

Secondly, look for divergence between the RSI and the price. For example, if the price hits a new high but the RSI does not, this divergence can be a strong signal that a price reversal might be near. Traders often use this as a signal to exit a long position or enter a short one.

Finally, consider the RSI in conjunction with other indicators. No single indicator is foolproof, and each has its strengths and weaknesses. Combining the RSI with other indicators such as Moving Averages or Bollinger Bands can provide a more holistic view of market conditions and potential signals.

By implementing these strategies and understanding the limitations of the RSI indicator, traders can use the RSI to help inform their trading strategies, minimize risk, and maximize potential returns.

Enhancing Your Financial Knowledge with RSI

Arming yourself with a deep understanding of the RSI indicator and its potential trading strategies can significantly enhance your financial education. A robust knowledge of such tools enables traders to decode market signals and trends accurately, providing an edge that can make a significant difference.

With the rise of electronic and algorithmic trading, the competition in financial markets has intensified. Given the financial market's complex and dynamic nature, trading without adequate tools like RSI could put you at a disadvantage. Using RSI to understand the overbought or oversold conditions helps traders time their transactions, offering the potential to maximise profits and limit losses.

Also, the RSI indicator provides qualitative insights into market sentiment. By learning to interpret the RSI, traders can start to comprehend the emotional factors driving market movements. This insight adds another dimension to your financial understanding.

Remember that RSI, like all technical indicators, is just one tool in a trader's arsenal. When integrating the RSI into your trading strategy, it's advisable to use it in conjunction with other financial tools. Pairing the RSI with other indicators like the Moving Average Convergence Divergence (MACD) or Bollinger Bands can provide corroborating evidence that strengthens your trading decisions.

In summary, incorporating the RSI into your trading toolkit not only enhances your financial knowledge but could also potentially improve your investment strategies in both traditional and cryptocurrency markets.

Conclusion: The Impact of RSI Indicator Strategies

In conclusion, the effective utilization of RSI Indicator Strategies can provide investors with a powerful tool in their trading arsenals. By identifying overbought and oversold market conditions, traders have the opportunity to predict possible market reversals and maximize their investment gains.

However, like all trading strategies, the RSI is not foolproof. It is paramount that other market factors and indicators are considered in conjunction with the RSI to make informed trading decisions. Overreliance on any single tool or metric can lead to suboptimal trading performance and potential losses.

Despite its limitations, the RSI remains an integral part of financial trading and market analysis. By combining it with sound fundamental analysis, good risk management practices, and a well-thought-out trading plan, it can certainly aid in making successful investment decisions.

As we conclude our journey into RSI Indicator Strategies, remember that the key to successful trading lies not just in understanding the tools at your disposal but also in how effectively you can make them work for you.

FAQs on RSI Indicator and Market Conditions

What is the RSI indicator?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It is used to identify overbought and oversold conditions in a market.

How does the RSI indicator identify overbought conditions?

When the RSI is above 70, it indicates that a security may be getting overbought or overvalued and might experience a reversal or corrective pullback in price.

How does the RSI indicator identify oversold conditions?

An RSI reading of 30 or below indicates an oversold or undervalued condition. During such conditions, the price may become a bargain, attracting buyers and pushing the price up.

Is the RSI indicator infallible?

No, the RSI indicator is not foolproof. False signals can occur, and price can stay in overbought or oversold territories for a long time, especially in a strong trending market.

How can the RSI indicator be used effectively?

The RSI indicator is most effective when it is used in conjunction with other technical indicators such as moving averages and candlestick patterns to confirm potential trend reversals.