Table of Contents:

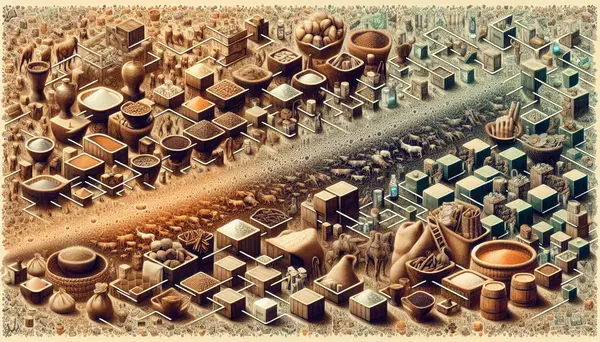

Welcome to this exciting exploration of the history of trading. In this article, we will take a captivating journey through time, looking at how trading has evolved from its earliest forms to the sophisticated systems we have today. Whatever your level of knowledge, this article aims to enrich your understanding of how our economic systems have developed and provide insights that could help you navigate the ever-changing financial markets. So strap in and prepare to delve into the world of commerce, from barter to blockchain.

Introduction: Understanding The Evolution of Trading

The act of trading is as old as human civilization itself. Since prehistoric times, mankind has engaged in some form of exchange or trade of goods and services. The desire for various items and the necessity of survival brought forth the concept of trading. Over the years, this seemingly simple activity has transformed dramatically, adapting to changes in society, technology, and global connectivity. Tracing its history, we find ourselves looking at a timeline that is parallel to our own development as a society.

The history of trading is an immense and intricate subject, touching every corner of human life. But don't worry, you don't need to be an economist or a historian to understand and appreciate its impact. By breaking down its evolution into key stages and turning points, it's possible for even beginners to grasp the complexity and become confident in understanding the trading world. From the primal barter system to futuristic blockchain technology, this story unfolds with surprising twists and enlightening insights that could redefine your perspective on trading.

Beginning Horde: Unraveling the Commodities Barter System

In the beginning stages of human societies, when there was no common currency or standardized system, people relied on direct barter. Basic necessities such as food, clothing, and tools were traded directly in a mutual exchange. This early trading method built around the principle of reciprocity. One party needed a good or service that another party had, and a direct trade took place between them. Merely based on both parties' needs and the availability of the goods.

While this system had its advantages – in its simplicity and its clear association of value for the traded goods – it was also characterized by significant limitations. For instance, a lack of standard value of goods and the common 'double coincidence of wants' issue, where both trading parties need to want what the other has to offer. The barter system's limitations prompted humankind to develop more sophisticated, standardized forms of trading. This realization marks the beginning of a crucial shift in the history of trading.

Advantages and Disadvantages of Trading Evolution: From Barter to Blockchain

| Advantages | Disadvantages | |

|---|---|---|

| Barter | Direct exchange, No need for regulatory authority | Double coincidence of wants, Indivisibility of goods |

| Currency Trading | Standardised value, Easy to transport | Potential for counterfeitting, Inflation and devaluation |

| Online/E-Commerce | Convenient, Wide variety of goods and services | Security concerns, Dependence on technology |

| Blockchain | Decentralized, Transparent, Reduced fraud | Legal implications, High energy consumption |

Ancient Civilizations and Coinage: Rise of Monetary System

The switch from barter to a monetary system is attributed to ancient civilizations. Finding a solution to the limitations of barter, the notion of money was introduced in the form of precious metals: gold, silver and sometimes, copper. Around 600 B.C., the Lydians (located in what is now Turkey) are credited with minting the first official currency. These coins were marked with a state seal, ensuring a specific weight of the precious metal, and designed to be uniform and identifiable. The introduction of coins represented a revolutionary movement in the history of trading.

With this new system, goods and services could now be assigned a fixed monetary value. This removed the need for the double coincidence of wants, making trading far more efficient. Money also served as a store of value, allowing people to save and accumulate wealth over time. The influence of this innovation is widespread, with most modern currencies tracing their roots back to this concept.

Coins became central to commerce and were adopted by many civilizations, influencing the rise of marketplaces within cities and prompting an increase in long-distance trade. Moving away from direct barter to a system of currency was the first notable milestone in our trading journey. As society evolved, so did our trading practices.

Middle Ages to 19th Century: Debut of Paper Money and Stock Exchanges

As we move forward in the history of trading, we see the turning point where commodity-based currencies were gradually replaced by a more lightweight and transport-friendly alternative: paper money. Originating in China during the Tang Dynasty around 618 A.D to 907 A.D, paper currency provided a more convenient method for representing value. It started as receipts issued by merchants for goods deposited in their vaults. These paper receipts were easier to carry and use for trade, marking a significant advancement in the trading evolution.

In the meantime, Europe saw the birth of marketplaces now known as stock exchanges. The Amsterdam Stock Exchange, established in 1602 by the Dutch East India Company, was the first of its kind. Investors bought shares in the company, giving them partial ownership, and received a part of the profits in return. It offered a new approach to raising money for companies and presented novel investment opportunities.

These exchanges provided a centralized place where buyers and sellers could meet and negotiate prices. Building on these early models, modern stock exchanges have become a central hub for economic activity across the globe, functioning as a barometer of a country’s economic health.

The history of trading during this period is characterized by two major advancements: the shift to paper currency and the rise of stock exchanges. Both developments were integral in shaping the financial world as we know it today.

20th Century Revolution: Electronic Trading and the Digital Age

The onset of the 20th century brought with it a technological revolution that dramatically changed the way we trade. Amongst the most striking developments was the advent of electronic trading. Stock exchanges began venturing away from the traditional outcry system, where traders shouted buy and sell orders on the trading floor, shifting towards quicker and more efficient computerized systems.

One monumental event was the launch of NASDAQ in 1971, the world's first electronic stock exchange, this marked a monumental leap forward in the history of trading. Now, traders could execute orders at the click of a button, making trading faster, more accurate, and accessible to many more people around the world.

Another key development during this digital age was the creation of the Internet. This powerful tool revolutionized how consumers and businesses interact. The Internet democratized access to markets and information on a scale unprecedented in the history of mankind. Online brokers like E*trade and Fidelity Investments enabled people to trade from their personal computers for the first time, opening the door to a new world of trading opportunities.

In the late 1980’s, foreign exchange (Forex) markets also started to take full advantage of the digital revolution. Quotations and trading became electronic, improving efficiency and reducing trading costs. As technology continued to advance, the proliferation of trading algorithms and high-frequency trading systems further accelerated the pace and complexity of markets.

By the turn of the century, computers and smart devices became increasingly prevalent, leading to the mobile trading revolution. Investors now have access to trading platforms anywhere, anytime, making trading truly global and inclusive.

Thus, the 20th century brought us the democratization of financial markets, a game-changer in the history of trading.

Trading Becomes Personal: Rise of Online Platforms and Forex Market

The concept of trading took a personal turn with the advent of online platforms and the Forex market in the late 20th century. This era in the history of trading is characterized by the democratization of the financial markets, making trading accessible to the average person, not just financial elites.

The galloping advancements in technology and the internet saw the birth of online trading platforms. These software applications provided an avenue for investors and traders to buy and sell financial instruments like stocks, commodities and currencies directly from their personal computers, without the need of human brokers. This evolution drastically changed the face of trading, as it enabled faster, more efficient transactions at any time and from anywhere in the world.

The Foreign Exchange market, commonly known as the Forex market, also gained prominence during this period. It became the world's largest and most liquid financial market, where currencies are traded in pairs. Its significance lies in its round-the-clock operation, large trading volume, geographical dispersion, and the increasing number of small, individual traders participating.

These developments made way for a more inclusive trading field, opening doors for people from different walks of life to participate in. The history of trading had never seen such an influx of participants and ease of access before.

21st Century Innovation: Enter Cryptography and Blockchain

As we entered the 21st century, the history of trading took an unforeseen, digital twist. With the advent of the Internet, came digital and mobile banking, revolutionizing the way we perceive and handle money. However, the icing on the tech-evolution cake was the introduction of cryptocurrencies like Bitcoin and the technology that underpins it - the blockchain.

Conceived by an anonymous person (or group) under the pseudonym Satoshi Nakamoto, Bitcoin emerged in 2009 as an open-source project. It was a new kind of digital money, one that wasn't managed by a centralized authority but maintained by computer networks running sophisticated algorithms. Powered by blockchain technology, the safety of financial transactions and the anonymity of users were highly prioritized.

Blockchain is a decentralized ledger system that records all transactions across a peer-to-peer network. It’s a transparent system where data is resistant to modification or unauthorized access, enhancing security in the trading process. This digitally democratic system has opened the door to innovations in various sectors, including finance, healthcare, entertainment, and more.

Today, there are numerous cryptocurrencies on the market, each with their unique features and uses. Trading is no longer limited to traditional stocks and commodities; digital assets have now entered the scene, and crypto-exchanges have become the modern marketplaces of our time. In just over a decade, the phenomenon of cryptocurrency has transformed the trading landscape, proving to be a game-changer in the history of trading.

Conclusion: Envisioning the Future of Trading

From humble beginnings with the barter system, the story of trading so far is a tale of relentless innovation and adaptation. We have shifted from a series of changes: commodities, to physical currency, then to virtual money, and now decentralised blockchain systems. Each transformation punctuating key shifts in our sociocultural fabric, while simultaneously propelling forward the sophistication and breadth of trading opportunities.

Where then, might the pendulum of trade swing in the future? If history has demonstrated anything, it is that the mechanisms of trade will continue to evolve. A strong contender for the next big shift is the fully embracing of blockchain technology. With its unique ledger system, it offers enhanced security, transparency and resilience – characteristics that surely hold much promise for the future of trading. We may not have a crystal ball to see into the future of financial transactions, but the current trajectory points towards a further blurring of geographical boundaries and a global market that operates around the clock.

So stay tuned, be adaptive, and better equip yourself by growing your understanding of these systems. For as we move onward, the history of trading continues to be written with you as a part of it. The avenue of trading is vast with diverse potential for all, ever-churning and innovating for the advantage of its participants.

FAQ zu der Evolution des Handels: Von Tauschhandel bis Blockchain

What is barter trade?

Barter trade is an ancient method of exchange where goods or services are directly exchanged for other goods or services of equivalent value without the use of money.

How has trading evolved over the years?

Trading has evolved from the simple barter system to a complex network of global trade involving currencies, digital currencies, stocks, commodities, and other assets, powered by technology such as electronic trading platforms and blockchain technology.

What is the role of technology in trading evolution?

Technology has played a crucial role in the evolution of trading by enabling faster, more efficient, and more transparent transactions. It has also broadened access to markets and allowed for the emergence of new trading instruments such as cryptocurrencies.

What is the impact of blockchain technology on trading?

Blockchain technology has the potential to revolutionize the trading system by providing a decentralized, secure, and transparent platform for transactions. It could eliminate intermediaries, reduce fraud, lower costs, and increase market efficiency.

What is the future of trading?

The future of trading could involve more automation, artificial intelligence, and the increased use of blockchain technology. This could lead to more efficient markets, improved risk management, and better investment strategies.