Table of Contents:

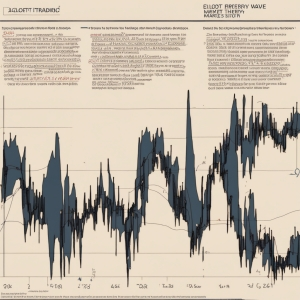

Welcome to this comprehensive guide on the Elliott Wave Theory, a powerful analytical tool that has the potential to supercharge your trading strategy! Our focus in this piece is to bring you a clear, easily understandable explanation of this theory and how applying the Elliott Wave in trading can give you an edge in predicting market patterns. This knowledge could prove invaluable whether you're a novice just stepping into the world of cryptocurrency or a seasoned investor looking to diversify your portfolio.

Introduction to Elliott Wave Theory

The Elliott Wave Theory, named after its creator Ralph Nelson Elliott, is a form of technical analysis used to predict the future direction of the market based on past price actions and cycles. Essentially, the theory suggests that markets move in specific patterns, called waves, that are driven by the collective psychology of investors.

Introduced in the 1930s, this theory has stood the test of time and gained acceptance among various financial disciplines, including the ever-evolving realm of cryptocurrency trading. Its value lies in its ability to identify trends and reversals, offering traders the foresight to make informed decisions.

At the core of the Elliott Wave Theory are the five-wave pattern moving in the direction of the trend, and a three-wave counter-trend pattern. The completion of a five-three move defines a full "Elliott wave cycle". These patterns are a fundamental part of the theory’s functionality and their understanding is crucial for its practical implementation in trading.

Now, let's delve deeper and explore some fundamental concepts related to the Elliott Wave Theory.

Understanding Market Cycles with Elliott Wave Pattern

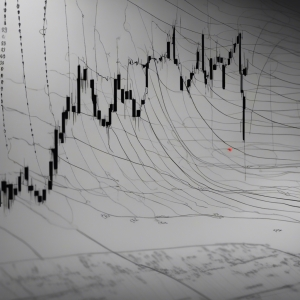

Applying the Elliott Wave pattern, you get to understand the structure of market cycles better. These cycles illustrate repetitive patterns driven by the market's collective mood, swinging between optimism and pessimism. Often, when a trend starts, it is marked by a wave of optimism causing price to shoot up. This is known as the impulse wave, which features five distinctive moves.

The impulse wave is followed by a period of market correction, where traders looking to cash in on profits send prices tumbling down. This period of downward trend actually forms the second half of the Elliott Wave pattern, known as the corrective wave. The corrective wave typically consists of three moves and represents a counter-trend to the initial impulse wave.

Understanding these complementary phases of market sentiment can provide a significant edge in predicting future price movements. Remember that Elliott Wave Theory relies on the idea that markets move in predictable patterns and that history often repeats itself. This reflects the human nature driving the markets: predictable in its unpredictability.

Next, let's walk through practical examples of how to use the Elliott Wave in trading, illustrating how this theory can help you make timely and informed trading decisions.

Advantages and Disadvantages of the Elliott Wave Theory

| Pros | Cons |

|---|---|

| Identifies market cycles and patterns accurately | Subjective and open to individual interpretation |

| Provides specific entries, exits, and stop loss levels | Relies heavily on accurate charting and drawing |

| Can predict broad market trends | Lower success when used on lower time frames |

| Useful in conjunction with other analysis tools | Detailed knowledge and experience required |

The Fundamental Principles of Elliott Wave in Trading

Grasping the fundamentals of the Elliott Wave theory equips traders with a clearer perspective of market scenarios. Understanding these principles allows you to detect market trends and reversals in advance, empowering you to make informed trading decisions accurately. So, what are these guiding principles?

The first principle states that the market price action is a direct reflection of changes in investor psychology. It's this switch between collective optimism and pessimism that drives the five-wave impulse sequence and the three-wave corrective sequence.

Moving on, the second principle suggests that each Elliott Wave, whether impulse or corrective, subdivides into smaller waves. The beauty of this concept is that it applies to waves of any size, making the theory fractal in nature. This inherent self-similarity at different scales gives the Elliott Wave Theory its unique adaptability to different timeframe charts.

The third principle relates to Fibonacci numbers, a sequence where each number equals the sum of the two preceding ones. Interestingly, Elliott discovered that the wave structures align pretty well with Fibonacci ratios, assisting in predicting the probable end of waves and the start of the correction phases. Traders often combine the use of Fibonacci retracement levels with the Elliott Wave Theory to optimize their market timing.

To tie it all together, using the Elliott Wave in trading involves identifying the wave patterns in market price data, understanding the underlying cyclical principles, and finally interpreting this information to forecast future price movement. Mastering this takes time and practice, but the rewards in terms of trading precision could be well worth the effort.

Predictive Power of Elliott Wave Theory

One of the most appealing aspects of Elliott Wave Theory is its predictive capabilities. By understanding and identifying the different wave patterns in the market, traders can anticipate possible price moves before they happen. This allows for timely investment decisions based on anticipated price action, rather than reacting to changes as they occur.

This ability to forecast market movements is reliant on the principle of market sentiment repetition. Markets, influenced by investor psychology, tend to exhibit similar behavior patterns over time. Thus, recognizing these patterns through the Elliott Wave Theory can offer priceless insights into possible future price action.

In essence, if you've identified an impulse wave in its early stages, you can usually predict with some degree of certainty that there will be a total of five up-and-down moves before the corrective phase begins. Similarly, once a corrective wave is underway, you can anticipate precisely when it's likely to end, paving the way for a reversal or continuation of the trend. The predictive power of Elliott Wave Theory places market participants in a preferable position, armed with valuable insights into what's likely to transpire in the markets.

Nevertheless, it's important to remember that as with all trading strategies and methodologies, accurate prediction isn't guaranteed. Market behavior can be influenced by countless factors and unpredictability is a part of the trading world. Using Elliott Wave Theory should be a part of a rounded trading strategy, backed up with other forms of research and analysis.

Practical Application of Elliott Wave Theory in Trading

Let's now examine how the Elliott Wave Theory can be practically applied within trading strategies. To maximize its benefits, traders should first identify a starting point to begin the wave count, which can either be a significant market high or low.

The traders then pinpoint the five-wave sequences and three-wave counter trends, taking into account the inherent fractal nature of these sequences. In essence, each larger wave consists of a series of smaller waves. More often than not, recognizing these patterns in every time frame will reveal the market's overall trend.

The Elliott Wave Theory also emphasizes the importance of Fibonacci ratios. The application of Fibonacci retracement levels in conjunction with wave analysis can be particularly beneficial for traders. These mathematical values can help predict the retracement levels that often align with the completion of wave sequences. By accurately estimating these key levels, traders can optimize their entry and exit points, enhancing their overall trading returns.

Furthermore, one significant advantage of applying the Elliott Wave in trading is the theory's flexibility. Whether you're involved in short-term day trading or long-term investment strategies, the theory's principles can be adapted accordingly to suit your trading goals.

However, it's crucial to note that like all trading strategies and tools, the Elliott Wave Theory isn't a foolproof method. It merely aids in making probable predictions, and there will always be instances where the market will move against these predictions. Remaining adaptable and using the Elliott Wave Theory in conjunction with other technical analysis tools can help overcome such trading hurdles.

Conclusion: Impact of Elliott Wave on Trading Strategies

In conclusion, the use of Elliott Wave in trading comes with a profound effect on one's trading strategies. Bringing an unprecedented level of depth and insight into the mechanics of market movement, the Elliott Wave Theory is indeed a trader's best ally in navigating the often unpredictable world of financial markets.

The implementation of this wave theory, with its focus on market psychology and cyclical trends, equips a trader with the tools to not just withstand market volatility but also to capitalize on it. The Elliott wave principle’s capability to shed light on the potential future price points makes it a compelling strategy for long-term investment decisions, as well as short-term trading setups.

Understanding and proficient use of the Elliott Wave pattern, combined with other technical analysis tools like Fibonacci retracement levels, can substantially enhance the accuracy of your market predictions. On the cutting edge of trading strategy, the Elliott wave principle is a game-changer, heralding a new era of informed and strategic trading.

Ultimately, the success of applying the Elliott Wave Theory lies in your hands - remember that consistent practice and experience in trading will refine your mastery of this complex yet invaluable tool.

Understanding The Elliott Wave Theory: Predicting Market Cycles

What is the Elliott Wave Theory?

The Elliott Wave Theory is a method of technical analysis for predicting market cycles by identifying extremes in investor psychology, highs and lows in prices, and other key financial market factors.

How does the Elliott Wave Theory work?

Elliott Wave Theory works by identifying recurring wave patterns that reflect the mass psychology of the investors. It assumes that markets in financial assets have strong trends that are determined by the shared behavior of traders.

What are the main components of the Elliott Wave Theory?

The main components of the Elliott Wave Theory are impulse waves and corrective waves. An impulse wave consists of five sub-waves and moves in the same direction as the trend of the next larger size. A corrective wave consists of three sub-waves and moves against the trend of the next larger size.

Can the Elliott Wave Theory accurately predict market trends?

While the Elliott Wave Theory can provide a framework for understanding market structures and potential future movements, like any analytical method, it should not be relied upon exclusively. The predictive accuracy of the Elliott Wave Theory can vary.

Who developed the Elliott Wave Theory and when?

The Elliott Wave Theory was developed by Ralph Nelson Elliott in the late 1920s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves.