Financial Instrument

Financial Instrument

Understanding a Financial Instrument in Trading

In the world of trading, a Financial Instrument is a key term that every beginner needs to grasp. To put it simply, a financial instrument is a contract between parties. It can be created, traded, adjusted and settled. It represents a legal agreement involving any kind of monetary value. Financial instruments are the fundamental assets that traders buy and sell in the financial markets.

How Does a Financial Instrument Work

Here's how a financial instrument comes to life: Party A lends money to Party B in the form of a bond. In this case, the bond is the financial instrument. The issuer (Party B) promises to pay a fixed amount of money to the lender (Party A) on a specific date. The contract also includes details like payment intervals and interest rates.

Different Types of Financial Instruments

Financial instruments are not limited to bonds. They come in various forms such as shares, debentures, futures, options, mutual funds, derivatives and more. Each of these financial instrument types has specific features that work best for different trading strategies.

The Importance of Financial Instruments in Trading

Understanding the different types of financial instruments can shape your trading strategy. It equips you to make informed decisions. Moreover, different instruments provide a variety of risk and return options. This means you can select an instrument that matches your risk tolerance and desired returns.

Summary: Financial Instrument

In conclusion, a financial instrument can be seen as the building block in trading. It's what traders buy and sell. Understanding them can help you identify potential trading opportunities. Remember, each type of financial instrument carries a different level of risk and potential return. Therefore, do diligent research before choosing your trading instrument.

Blog Posts with the term: Financial Instrument

Gemini is a cryptocurrency exchange known for its strong security and user-friendly interface, offering services like the Gemini Dollar stablecoin and advanced trading options. The platform emphasizes regulatory compliance and provides educational resources to support informed trading decisions....

DeFi trading leverages blockchain technology and smart contracts to enable peer-to-peer asset trading on decentralized exchanges (DEXs) without intermediaries, offering benefits like lower fees, enhanced security, transparency, and greater accessibility. Key technologies in DeFi include blockchains such as Ethereum, smart...

Cripto Intercambio refers to online cryptocurrency exchange platforms where users can buy, sell, or swap various cryptocurrencies and convert them into traditional currencies. These exchanges provide a secure environment with features like KYC compliance for user registration, low transaction fees,...

LedgerX is a regulated financial platform established in 2013 that offers cryptocurrency derivatives such as options, futures, and swaps to both retail and institutional investors. It provides a secure trading environment with features like mini contracts and physical settlement, catering...

In Denmark, cryptocurrencies are classified as personal assets and subject to income tax rather than capital gains tax, requiring investors to accurately report transactions for compliance. Understanding the applicable tax rates and maintaining detailed records is crucial for managing crypto...

Levex, or leveraged trading, allows traders to increase market exposure and potential profits using borrowed funds but also amplifies risks. It requires a strong understanding of trading fundamentals and robust risk management strategies due to the heightened potential for both...

BTCC, one of the first cryptocurrency exchanges founded in 2011, has evolved to meet market demands by offering innovative trading services and maintaining a commitment to security and regulatory compliance. It sets itself apart with features like user-friendly interface, diverse...

Artificial intelligence (AI) is revolutionizing cryptocurrency trading by providing tools that analyze vast market data for informed decisions, reducing risks and increasing profits. AI systems learn from each trade to improve strategies in the volatile crypto environment, utilizing algorithms, machine...

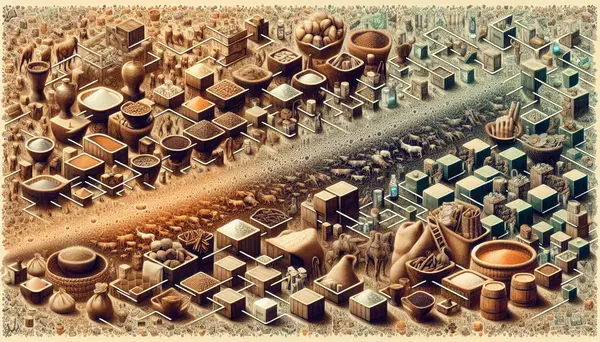

Welcome to an exploration of the history of trading, from its earliest forms to the sophisticated systems we have today. This article breaks down the evolution of trading, from barter to blockchain, and discusses the advantages and disadvantages of each...

market price. Futures contracts allow traders to speculate on the future price movements of cryptocurrencies and potentially profit from them. Understanding Crypto Options Options, on the other hand, give the buyer the right but not the obligation to buy or sell a...

Bitstamp is a reputable cryptocurrency exchange established to offer secure and user-friendly trading services, catering to both beginners and experienced traders with its focus on reliability and regulatory compliance. Founded in 2011, Bitstamp has adapted through various challenges by moving...

The article explains the concept of the pullback play, a trading strategy that involves entering trades at strategic points after a temporary reversal in price. It discusses the pros and cons of this strategy, the key components of a pullback,...

Understanding Market Depth: The Battle of Supply and Demand Market Depth Analysis is a crucial tool for traders and investors to understand the supply and demand dynamics of the financial market. By analyzing the order book, traders can gain insights into...

Leveraging ETFs is a strategy that allows investors to enhance their exposure to a particular market or asset class. By borrowing funds to increase investment capital, investors can potentially amplify returns. However, leveraging also comes with increased risk and the...

ByBit is a cryptocurrency derivatives exchange launched in 2018, offering tools and features for both novice and experienced traders to enhance their trading strategies. It differentiates itself with leveraged trading options, an advanced order system, high-performance matching engine, comprehensive customer...