Electronic Trading

Electronic Trading

Understanding Electronic Trading

When it comes to the world of trading, there's no shortage of terms and phrases that can leave beginners feeling overwhelmed. One term you need to understand is Electronic Trading. Primarily, Electronic Trading refers to the act of buying or selling securities on electronic platforms. This concept plays a key role in the global trading landscape.

The Birth of Electronic Trading

In the past, all trading took place on physical exchange floors. Traders would shout orders, use hand signals, and closely watch tickertape. This was a bustling, chaotic scene. But in the late 20th century, Electronic Trading emerged. The focus shifted from shouting and hand signaling to tapping keys on computers. This shift has been a game changer when it comes to making trades with speed and ease.

The Impact of Electronic Trading

Traditional methods did not offer seamless trading. Delays were common. Orders had to pass through multiple hands before execution. Electronic Trading platforms changed the game. They have made share trading quicker, more efficient, and more transparent. This modern trading method offers real-time pricing. It also provides immediate transaction times.

High-Frequency Trading: A Branch of Electronic Trading

As technology advanced, new forms of Electronic Trading emerged. One such form is High-Frequency Trading (HFT). This style uses advanced technologies. The aim is to make trades at high speeds and in large volumes. These trades often involve small price differences. This also requires complex algorithms to identify market trends in real time. HFT is an advanced form of Electronic Trading. It's a perfect example of the direction this trading type has taken.

Understanding the Platforms

Electronic Trading platforms are pivotal in this type of trading. Traders view live market prices. They execute trades through these platforms. Some of the most widely used platforms include E*Trade, TD Ameritrade, and Interactive Brokers. Each of these has unique features. But all offer the basic functions needed for successful electronic trading.

Risks and Rewards of Electronic Trading

Like all forms of trading, Electronic Trading has its pros and cons. One of the main advantages is speed and efficiency. Yet, it's not without risks. These can include system failures or cyber-security threats. Furthermore, the quick pace of trading can lead to rapid losses. Knowledge, careful strategizing and sound risk management are vital for success in Electronic Trading.

Blog Posts with the term: Electronic Trading

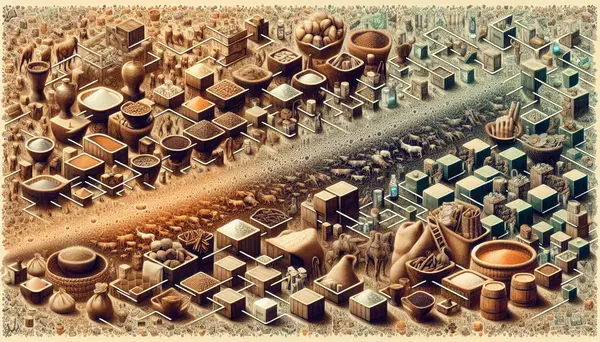

Welcome to an exploration of the history of trading, from its earliest forms to the sophisticated systems we have today. This article breaks down the evolution of trading, from barter to blockchain, and discusses the advantages and disadvantages of each...

Algorithmic trading uses computer algorithms to execute trades with speed and precision, leveraging strategies like trend following or arbitrage while relying heavily on data analysis; it has evolved from simple automation in the 1970s to high-frequency trading today....

Trading floors, once bustling hubs of human interaction and open-outcry systems, have evolved into hybrid spaces combining traditional expertise with electronic efficiency to adapt to modern financial markets. While digital platforms dominate today’s trading landscape, the legacy of physical trading...