Broker

Broker

Understanding the role of a Broker in Trading

Trading is a vast field that involves a network of key players, and one crucial participant often mentioned is the broker. So you might be wondering, 'What exactly does a broker do?'.

Who is a Broker?

In simple terms, a broker is a person or firm that serves as a mediator between buyers and sellers. They facilitate the trading process in return for a commission or fee. Think of them as a bridge that connects you to the market.

The Role of a Broker in Trading

The role of a broker in trading can't be understated. They make trading operations smoother and more accessible to everyone. Brokers provide platforms or services which individuals use to buy or sell assets such as stocks, forex, commodities, and more. They play a key role in executing trades on behalf of their client traders.

Different Types of Brokers

There are primarily four types of brokers: Full-service brokers, discount brokers, online brokers, and direct market access (DMA) brokers. Full-service brokers provide a range of services including market research and investment advice. Discount brokers offer fewer services but charge lower fees. Online brokers perform trades on digital platforms, while DMA brokers offer sophisticated tools for experienced traders.

Choosing the Right Broker

When it comes to trading, selecting the right broker is crucial. Factors such as the type of asset you want to trade, the level of customer support, the charges and fees, and the broker's reputation all come into play. It's important to choose a broker that suits your trading style and goals.

Key Takeaway

The broker is a key player in the trading landscape. Whether you're a newbie exploring the investment world or an experienced trader, understanding the role of a broker can greatly enhance your trading journey.

Blog Posts with the term: Broker

DeFi trading leverages blockchain technology and smart contracts to enable peer-to-peer asset trading on decentralized exchanges (DEXs) without intermediaries, offering benefits like lower fees, enhanced security, transparency, and greater accessibility. Key technologies in DeFi include blockchains such as Ethereum, smart...

Insider trading involves using non-public, material information to trade securities and can be legal if conducted transparently or illegal when exploiting unfair advantages. Legal insider trading requires adherence to disclosure rules, while illegal cases like Rajaratnam's Galleon scandal highlight severe...

Levex, or leveraged trading, allows traders to increase market exposure and potential profits using borrowed funds but also amplifies risks. It requires a strong understanding of trading fundamentals and robust risk management strategies due to the heightened potential for both...

Bitcoin, the first cryptocurrency based on blockchain technology, has gained popularity as a decentralized digital currency and investment asset. Comdirect, a German online banking platform, now allows users to buy Bitcoin directly through their services without needing an external wallet,...

Flatex is an online broker offering a range of services for traders at all levels, featuring an intuitive platform with educational resources and advanced trading tools like real-time market data and direct market access. While it provides numerous benefits such...

XGo is a comprehensive crypto trading platform that offers advanced features and robust security to facilitate the buying, selling, and trading of various cryptocurrencies. It provides an intuitive user interface suitable for both beginners and experienced traders, supports multiple payment...

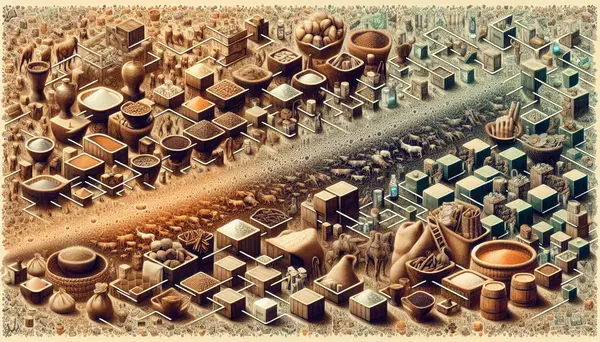

Welcome to an exploration of the history of trading, from its earliest forms to the sophisticated systems we have today. This article breaks down the evolution of trading, from barter to blockchain, and discusses the advantages and disadvantages of each...

Leveraging ETFs is a strategy that allows investors to enhance their exposure to a particular market or asset class. By borrowing funds to increase investment capital, investors can potentially amplify returns. However, leveraging also comes with increased risk and the...

DeFi, or Decentralized Finance, is a movement that leverages blockchain technology to create transparent and trustless financial protocols without intermediaries. It aims to make financial systems more accessible and efficient, allowing individuals to participate in activities like lending, borrowing, and...

This article serves as a beginner's guide to ETF trading, explaining what ETFs are, how they work, and their benefits and drawbacks. It also provides step-by-step instructions on how to start trading ETFs by determining investment goals, selecting the right...

Luno is a cryptocurrency trading platform that emphasizes simplicity, security, and accessibility for both beginners and experienced traders. It offers an intuitive interface with educational resources to help users make informed decisions, along with features like diverse crypto trading options,...

TradingView is an online platform that provides users with a range of tools for trading and analyzing financial markets. It offers interactive charts, real-time market data, and a variety of analytical tools to help traders make informed decisions. The platform...

This article discusses the difference between investing and trading in the financial markets. It explains that investing is a long-term strategy focused on gradual wealth accumulation, while trading is a short-term approach aimed at profiting from price fluctuations. The article...

In this article, the concept of algorithmic trading in the cryptocurrency market is explained. The benefits include faster transaction times, more accurate trades, and reduced costs, while drawbacks include high setup costs, limitations in understanding market details, and the risk...