Basket

Basket

Understanding the Concept of a 'Basket'

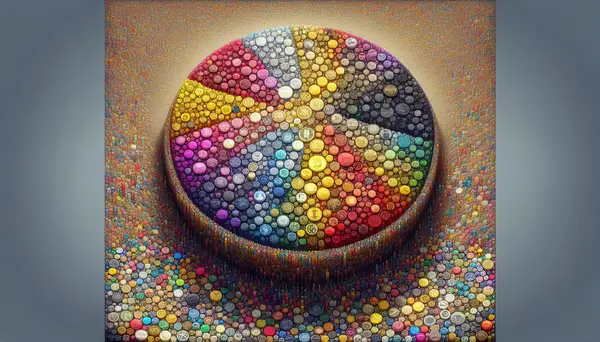

In the realm of trading, the term Basket has a specific meaning. A Basket refers to a collection of various securities brought together into one entity for trading purposes. Typically, these securities could include stocks, commodities, futures, currencies or ETFs (Exchange Traded Funds).

Why Use a Basket in Trading?

The concept of a Basket is used in trading to diversify your investment. It allows you to invest in a variety of assets, spreading your risk across different kinds of securities. This can help safeguard your investment as the potential loss in one asset could be offset by gains in others contained within your Basket.

How Does Basket Trading Work?

In a Basket trade, you buy and sell a group of securities as one. All securities within the Basket are given equal importance and treated as one unit. It’s important to remember, the value of your Basket is not static, it fluctuates with the market changes.

Benefits of Basket Trading

There are two primary benefits of Basket trading. Firstly, it diversifies your portfolio, spreading your investment risk. Secondly, it can give you exposure to numerous markets and industries without requiring a large amount of individual transactions.

Illustrating Basket in Action

For example, an investor might compile a Basket of blue-chip stocks from various sectors such as technology, healthcare, and consumer goods. If the tech sector experiences a downturn, the loss may be cushioned by stability or gains in healthcare and consumer goods.

Creating Your Own Basket

You might choose to create a custom Basket based on your interests or the sectors you believe will do well. Taking the time to carefully select and manage your Basket can increase your chances of a good return.

Blog Posts with the term: Basket

This article discusses the psychological pitfalls that traders often face in the world of cryptocurrency trading. It explores emotions such as fear, greed, and overconfidence, and provides practical tips on how to avoid falling into these traps. Additionally, the article...

DeFi trading leverages blockchain technology and smart contracts to enable peer-to-peer asset trading on decentralized exchanges (DEXs) without intermediaries, offering benefits like lower fees, enhanced security, transparency, and greater accessibility. Key technologies in DeFi include blockchains such as Ethereum, smart...

Bitpanda is a European platform for cryptocurrency trading that offers an easy-to-use interface and diverse digital assets, including cryptocurrencies and precious metals. It emphasizes security with measures like encryption and cold storage, while providing features such as Bitpanda Pay and...

The article provides an introduction to portfolio diversification and explains its importance in investment. It discusses the benefits and risks of diversification in portfolio management, including risk management, return on investments, and managing volatility. It also explores the role of...

market price. Futures contracts allow traders to speculate on the future price movements of cryptocurrencies and potentially profit from them. Understanding Crypto Options Options, on the other hand, give the buyer the right but not the obligation to buy or sell a...

The article discusses the basics of cryptocurrency trading and provides a step-by-step guide for beginners. It explains what cryptocurrencies are, the pros and cons of crypto trading, and the necessary tools like exchanges and wallets. The article emphasizes the importance...

Leveraging ETFs is a strategy that allows investors to enhance their exposure to a particular market or asset class. By borrowing funds to increase investment capital, investors can potentially amplify returns. However, leveraging also comes with increased risk and the...

This article serves as a beginner's guide to ETF trading, explaining what ETFs are, how they work, and their benefits and drawbacks. It also provides step-by-step instructions on how to start trading ETFs by determining investment goals, selecting the right...

dYdX is a decentralized exchange (DEX) on the Ethereum blockchain offering advanced trading options like spot, margin trading, and derivatives without intermediaries. It features an order book model for price matching, leverages off-chain order books with on-chain settlement using StarkWare’s...

The article discusses the rise of cryptocurrency ETFs as a bridge between traditional finance and the world of cryptocurrencies. It explains how ETFs work, the pros and cons of investing in crypto ETFs, and the potential impact of crypto ETFs...

The article introduces readers to the world of cryptocurrency trading, emphasizing the importance of developing a personal trading strategy. It explains the basics of trading and discusses the pros and cons of DIY trading. The article then provides guidance on...

Portfolio optimization is the process of selecting the best mix of investments for a portfolio while balancing the tradeoff between risk and return. Techniques such as diversification, Modern Portfolio Theory (MPT), and Risk Parity can be used to achieve this...

Swing trading strategies have become popular for capturing short-to-medium term price movements in the market. This article provides an introduction to swing trading, compares it to other investment strategies, discusses the pros and cons, and explores the core principles and...

Bear market trading refers to the strategy of trading during a bear market, where prices are falling and pessimism is widespread. This article provides insights into the basics of bear market trading, including strategies such as diversification, buy-and-hold, defensive stock...

Altcoins are cryptocurrencies that offer different features and improvements over Bitcoin, providing various technological advancements and investment opportunities. Successful altcoin trading involves strategies like technical analysis, fundamental evaluation, diversification, discipline in decision-making, staying informed on market news, using essential tools...